You need someone who can hit the ground running because they need to be part of the team leading your startup’s growth, not following behind it. While accountants usually have a broad range of knowledge when it comes to finances, they are by no means authorities nor specialize in all areas of financial management. There are a few other roles you will want to consider when developing your financial team. Several software options are designed specifically for accounting.

Monthly bookkeeping tasks

While you might pay a premium for insurance now, it usually does not compare to the cost you would have had if you had not been able to file a claim. In practice, this neat separation between contractor and employer might not always exist. In many industries, it is common for contractors to work with in-house teams, receive company-specific training, and bill hourly.

Of The Best Funded Startups Trust Kruze

Uncomplicated navigation, an attractive, intuitive UI, and exceptional mobile access add to its appeal. It’s missing some features that competitors offer, and it includes some language and concepts that rivals keep in the background, but it’s a solid, inexpensive solution. It’s actually a full-featured, double-entry accounting https://www.bookstime.com/ system that happens to offer an exceptional user experience. For these reasons, it’s an Editors’ Choice winner and is one of the first accounting options a small business should consider. It’s intuitive enough for novice bookkeepers to learn but supports all the elements that a larger business would need, including payroll.

Accounting For Startups: Everything You Need To Know In 2024

- Some apps provide context-sensitive help along the way and a searchable database of support articles.

- However, growing businesses will outgrow FreshBooks quickly as it’s generally best for very small businesses and sole proprietors.

- Additional features include project accounting (Established plan), inventory management, and a strong PO system.

- We’ve included everything from why and how to budget, to free financial model templates, to record keeping, to taxes and more … We like to call it the ultimate guide to startup accounting.

This individual and their team work with you on customizing your setup and monitoring your transactions so they’re accurately entered and categorized for tax purposes. accounting and bookkeeping service for startups They reconcile your accounts and close your books at month’s end to prevent errors. Plus, they’re available for questions during regular business hours.

These principles of accounting not only ensure the completeness of your accountant’s work but are also expected by funders who review your books. First and foremost, you will want an accountant that is forward-looking and aims for growth, growth, growth! They should be able to tell you about businesses they have worked with through numerous fundraising stages. Unlike a bookkeeper, a certified public accountant (CPA) can represent your business in a tax audit if your CPA is an Enrolled Agent (EA) with the IRS. Further, a bookkeeper will generally not be able to help you assess the cost of your operations and find areas for savings. An accountant, not a bookkeeper, would generally conduct internal financial audits.

- Effective accounting practices and sound financial management results in returns for the stakeholders and business owners.

- As you probably already know, starting a new business is a lot of work!

- Firms that rely on automated accounting systems or who provide limited services can easily miss potential problems, like invoicing issues, double payments, and missed collections.

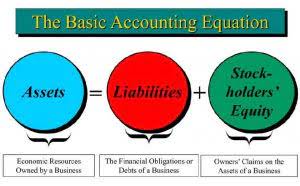

- To ensure that journal entries have been recorded and posted correctly, small businesses use the trial balance accounting method to double-check account balances for a given time period.

- But regular sound professional advice is invaluable and can make your business successful.

- Launching your own business requires a lot of money, and it’s likely that the need to borrow will eventually rise.

- Vanessa is a CPA and the founder of Kruze Consulting, and has helped hundreds of startups with their accounting and taxes.

- Our history as pioneers in accounting technology and automation is well established.

- Let’s talk about what they are and where to seek out good guidance.

- The research and development, or R&D tax credit, is a US government-sponsored incentive that rewards companies for conducting research and development activities within the United States.

- For these reasons, it’s an Editors’ Choice winner and is one of the first accounting options a small business should consider.

- In addition to supporting accounting and planning functions, most ERPs come ready to integrate with other software and apps that generate data about your business.

- For freelancers and professionals, Indy provides end-to-end, AI-powered accounting software.

- It’s also ideal for businesses that would make use of the lion’s share of its well-integrated features, and that need powerful reporting tools.

- Here are the things to look out for when looking for an accountant for startups.

- They will have a working knowledge of the cost of various options to help you arrive at a solution that fits your business plan and budget.